This post may contain affiliate links. Please read our disclosure policy.

Recently, Farfetch acquired New Guards Group, the Milan-based parent company of Heron Preston, Palm Angels and most famously Off-White.

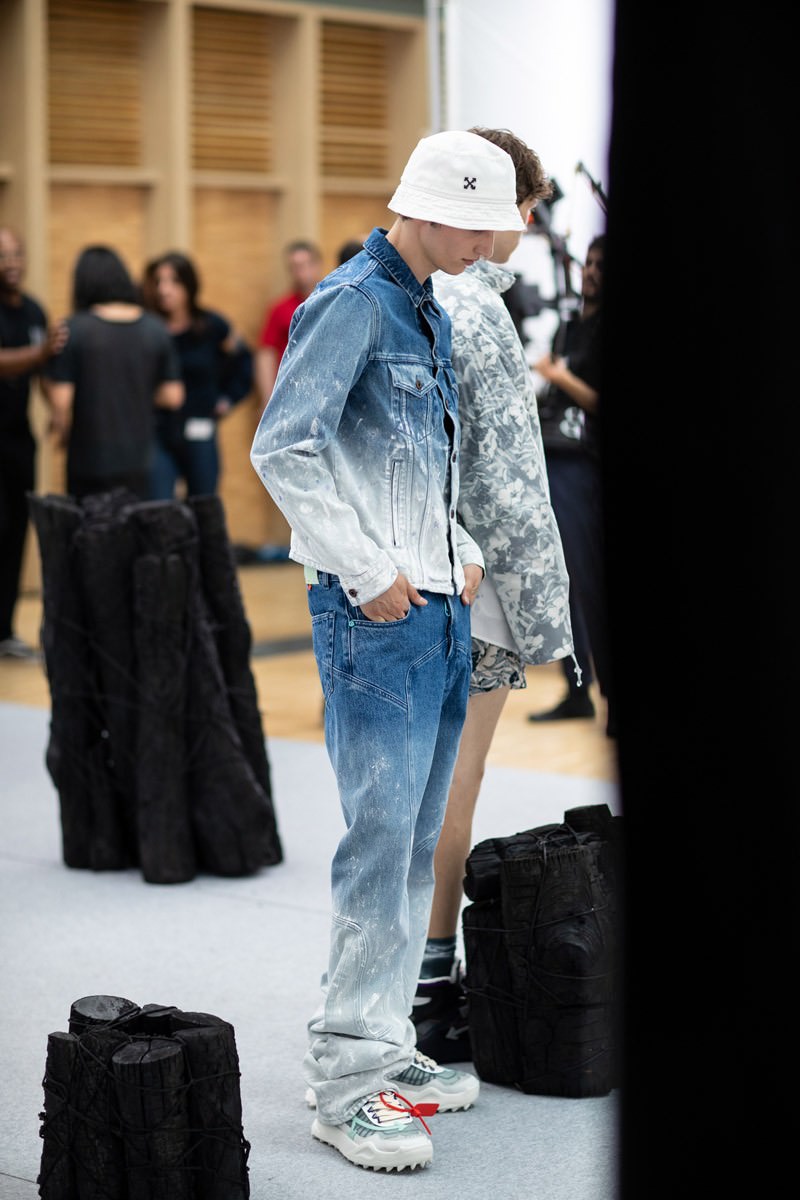

While a representative for Off-White stated that Off-White LLC is still “controlled by Virgil Alboh” and that the NGG transaction to Farfetch “will not affect Off-White™ day to day operations,” the transaction as a whole has the potential to shape the speed, scale and strategy of streetwear as we know it.

According to Fashionista, Farfetch will be able to leverage both its retail network reach and customer data for the acquired brands while being able to greater power their e-commerce sites. Farfetch is looking to both build and power ‘the brands of the future.’

“The brands of the future will have three core elements. First, a creative tastemaker able to leverage digital channels to engage a global community; second, best-in-class design, planning and manufacturing; and third, direct-to-consumer global online distribution, complemented by a connected wholesale presence in the most prestigious physical boutiques,” Farfetch CEO José Neves said in a statement.

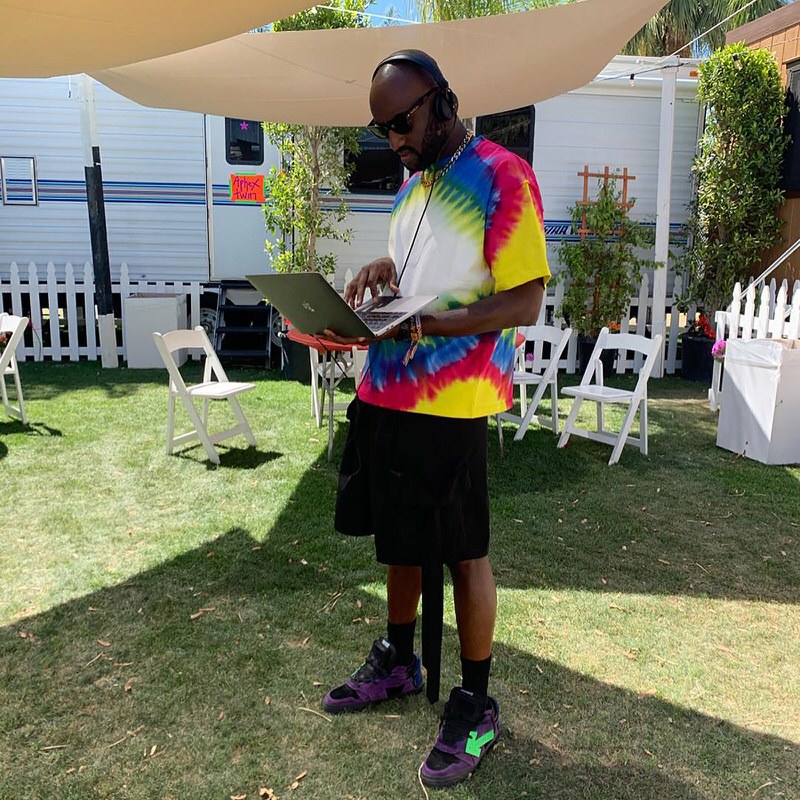

By all accounts, Off-White is not just the case study for ‘the brands of the future’ but rather the standard. Virgil is the creative tastemaker of creative tastemakers when it comes to leveraging his social media understanding. While ‘best-in-class design’ could be debated as it’s all subjective, the accolades, influence and sales attributed to Virgil and Off-White back such a high title.

As for direct-to-consumer global online distribution, perhaps this is where Farfetch could make Off-White grow the most.

At this time, Off-White ranks among Farfetch’s top 10 brands in regards to Gross Merchandise Value but is only sold online through Farfetch’s boutique partners meaning most of those sales come through wholesale.

Farfetch is said to both power the new Off-White e-comm site and align the brand’s inventory with that of its boutique carriers for what’s being called “connected wholesale.”

As Fashionista puts it, “Farfetch plans to match supply and demand in near-real time by leveraging its connections with 650+ retailers, thereby improving sales and profit margins, and lessening the risk of unsold inventory that would need to be discounted.” That is a lean and mean business model.

Essentially, the world’s most savvy streetwear brand is getting smarter, faster, stronger and most importantly more efficient. In an “I need it now” marketplace, Off-White should be easier to access in regards to online ability but also sell-through faster as a brand due to “connected wholesale” ethos.

So, does that mean Off-White will sellout faster and essentially never go on sale? In a perfect world for Farfetch and Off-White, yes. While such a scenario is more likely now but still unlikely, that could mean big things for both Off-White online and on the aftermarket. Lucky for Farfetch, they’ve got stakes in the whole game.

Not only does Farfetch have an intimate piece of the streetwear game – now housing the brand that both created and exploded the growing genre and spawns numerous footwear collabs – it also holds a valuable piece of the aftermarket for the adjacent footwear category.

In late 2018, Farfetch acquired Stadium Goods. The New York hot spot that plays host to the hottest releases of both the last weekend and the last decade has boomed in exposure thanks to its big budget acquisition and familiarity with kick collectors thanks to Sneaker Shopping.

To sum it up, the Farfetch acquisition of NGG involving Off-White has the power to make Off-White grow at a more powerful rate and make it more accessible in regards to online shopping. With that said, the statement from Off-White following the acquisition suggests it will be “BUSINESS AS USUAL” for Virgil and Co.

Still, Farfetch isn’t dropping a whopping $675 Million on NGG if they don’t want to make Off-White, Palm Angels and Heron Preston bigger in some fashion than they already are.

So, will it be “The 10” times 30? Eh, probably not. Even as high-end streetwear becomes both more mainstream and more global what the deal could yield is something even bigger.

The next Off-White.

As GQ points out, luxury fast-fashion is such a big business because it’s always on. Factories that literally operate 24/7 make it possible with new funding likely making these brands bigger and faster as earlier alluded.

While factories make the product, they don’t necessarily make it cool or make it modern.

And this is where it gets interesting.

According to Fashionista, the acquisition will give Farfetch NGG’s “design, production and brand development capabilities.”

Backed by GQ, Farfetch will be “porting over the process that makes it possible for Off-White to play in the fast-paced age of Instagram. Soon, Farfetch will be able to create its own brands using this same system.”

Already having the ever-so-important infrastructure, Farfetch could now have the data, the resources and the recipe to make the next big brand. That next big brand could start the next big trend, have the next big shoe collab, etc.

“This is what the combination of Farfetch and New Guards brings to the industry,” Farfetch’s CEO said in a statement. “Together, we can not only continue to develop New Guards’s current portfolio, but will also be uniquely positioned to bring many new talents to life with the combined layers of the Farfetch platform.”

GQ likens Farfetch in this sense to Netflix. While Netflix got on and poppin’ showing other people’s movies they really became the industry standard once they started making their own TV shows.

Essentially, the next big brand could be taking shape right now.